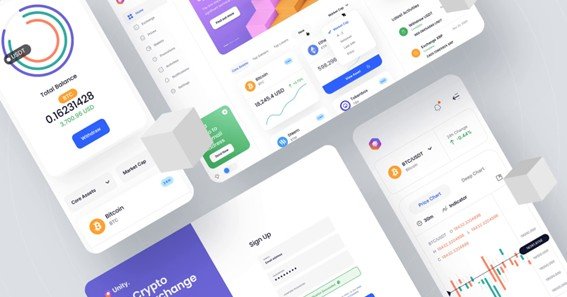

UnityMeta Token (UMT) is a decentralized cryptocurrency operating on the Binance Smart Chain (BSC). It is designed to facilitate various applications within the metaverse and decentralized finance (DeFi) ecosystems.

Key Features of UnityMeta Token

- Decentralized Finance (DeFi) Integration: UMT is engineered to support DeFi applications, enabling users to engage in financial activities without intermediaries. This includes staking, where users can earn rewards by locking their tokens to support network operations.

- Token Burn Mechanism: A unique aspect of UMT is its token burn strategy. With each transaction, 0.1% of the tokens are burned, reducing the total supply over time. This deflationary mechanism aims to increase the token’s value as scarcity grows.

- Metaverse Applications: UMT is tailored for use within virtual environments, allowing for seamless transactions and ownership of digital assets in the metaverse. This positions it as a versatile tool for virtual interactions and commerce.

Current Market Performance

As of December 27, 2024, UMT is trading at approximately $110.82 USD per token, with a 24-hour trading volume of around $22,353.37 USD. The token has experienced a 2.0% decline in the past 24 hours and a 13.4% decrease over the past week. The all-time high was $504.66, recorded on July 3, 2023, indicating a significant depreciation since that peak.

Acquiring UnityMeta Token

UMT can be acquired through decentralized exchanges, with PancakeSwap (v2) being the most prominent platform for trading UMT. Users can trade UMT against Binance Coin (BNB) or stablecoins like USDT. It’s essential to use the correct contract address to avoid counterfeit tokens.

Considerations and Risks

Potential investors should exercise caution due to several concerns:

- High Staking Rewards: UMT offers staking rewards of up to 12% monthly (144% annually), which is considerably high and may not be sustainable.

- Withdrawal Fees: A 5% fee is imposed on withdrawals, which could impact net returns.

- Market Volatility: The significant drop from its all-time high reflects high volatility, a common characteristic in the cryptocurrency market.

Conclusion

UnityMeta Token presents an intriguing opportunity within the DeFi and metaverse sectors, offering features like a token burn mechanism and high staking rewards. However, potential investors should conduct thorough research and consider the associated risks before engaging with UMT.

FAQ

- What is UnityMeta Token (UMT)?

- UMT is a decentralized cryptocurrency on the Binance Smart Chain, designed for applications in DeFi and the metaverse.

- How does the token burn mechanism work?

- With each transaction, 0.1% of UMT tokens are burned, reducing the total supply over time.

- Where can I buy UMT?

- UMT is available on decentralized exchanges like PancakeSwap (v2).

- What are the staking rewards for UMT?

- UMT offers staking rewards of up to 12% monthly, equating to 144% annually.

- What are the risks associated with investing in UMT?

- Risks include high market volatility, unsustainable staking rewards, and withdrawal fees. It’s crucial to conduct thorough research before investing.